What is better for the economy: a large monopoly corporation or a few small and medium-sized companies?

Global corporations are taking over the world more and more. And it is already difficult to imagine everyday life without some kind of product or service that they produce. Facebook, Apple, Amazon, Netflix, Google, and Microsoft are already so ingrained in our daily routines that it's almost impossible to imagine anyone else pushing them out.

Every year, all these corporations only grow, increasing the number of their employees, profits, and the value of shares on the stock exchange. This leads to the fact that 4 companies have created the so-called "Trillionaires Club", which includes Apple, Amazon, Microsoft, and Alphabet (Google), these are companies whose capitalization exceeds $ 1 trillion.

They all have at least 2 things in common: the companies are based in the United States and operate in the technology sector. The US is a country about business and for business, and right now there is perhaps no better place on Earth to grow your company to an international level. And the service sector forms more than 70% of the entire American economy.

According to the annual report Global 2000, which includes the world's largest public companies, almost 30% of the companies on the list are in the United States of America (575 out of 2000).

Such companies certainly make a significant contribution to the country's GDP, create new jobs, and simply push technology and overall progress forward. But on the other hand, there is also a completely negative impact of this kind of large-scale business.

Monopoly

How is the term "monopoly" defined? According to the dictionaries, a monopoly is "complete control over the entire supply of goods or services in a specific area or market." The implication is that monopoly companies are capable of destroying competitors and dictating their prices.

Tech giants are facing pressure, both in the US and in Europe. European regulators have already issued several multi-billion dollar fines to these companies, and so is the US Federal Trade Commission (FTC). And one of the 2020 presidential candidates, Elizabeth Warren, is building her campaign on unbundling corporations due to their current overgrowth and influence.

The competition in technology is very fierce, not to mention sectors such as the hydrocarbon industry, where it is now almost impossible for a new company to enter. All these companies have long been crushed by states, but this is a completely different conversation.

Last year the FTC investigated "hundreds" of past acquisitions made by Microsoft, Google, Apple, Amazon, and Facebook over the past 10 years. Regulators wanted to know if there have been purchases of smaller companies in order to minimize future competition.

There have been quite high-profile acquisitions over the past few years, with Instagram and WhatsApp joining Facebook, Google acquiring FitBit, and WholeFoods merging with Amazon. Apple buys companies every few weeks.

It is profitable for large corporations to buy small companies for several reasons. First, the takeover of a young and promising company with its own technology minimizes the risk that this company will grow into a formidable competitor. Secondly, it is human resources and time, from a spatio-temporal point of view, it is much more convenient to buy a working company and build it into your structure than to build some new product yourself and from scratch. The corporation also gets "good brains" in terms of people - new employees and all these investments quickly pay off.

It's increasingly difficult for young startups to compete with the giants in terms of salaries. And many developers have a question whether it is worth the risk or is it easier to go to a world-renowned company, where stability and high earnings await you.

Peter Thiel, one of the founders of companies such as PayPal and Palantir, advocates "the right monopoly" and says that competition is not always good, as all its players suffer. He says if you are going to start a business, aim a priori at creating a monopoly. But the most important thing is that the company does not need to openly position itself as a monopoly. Google and Apple often talk about the presence of a wide range of competitors in their niches, constantly belittling their success and the market share they own. However, when you look at their income and the number of people using their products, the competition is certainly not as obvious as they claim it is.

Amazon is called the future corporation of evil. In the US, the company owns over 45% of the entire e-commerce market. Almost every second product on the Internet is bought on Amazon. The parcel by the courier can be received on the same day, the company is opening more and more grocery stores around the country, it produces its own products, for example, the Alexa smart speaker and has the richest person in its composition at the moment.

No one even argues how much Amazon makes life easier for millions of people, but critics are increasingly talking about the dangers of the company's growth. They say that it can grow to such an extent that it will be simply impossible to regulate it. This is not to mention the money and influence this tech giant will have.

And with Donald Trump's tax cut, which began in 2017, corporations have begun to feel even more at ease. Thanks to these indulgences, for example, Amazon and Netflix managed to avoid paying federal taxes, meaning they literally had to pay $ 0 on their billion-dollar earnings in the United States. While small and medium-sized businesses have to pay in full.

There are also some places (countries) where corporations open their headquarters, outside the United States, where they transfer all their income from other countries, minimizing taxes that they could pay in each individual country.

But European countries have already gotten to this scheme, last year France approved its digital tax on tech giants, which Donald Trump and the United States do not agree with. Austria followed, but it is not yet known how far this practice will go.

Resource accumulation and billionaires from companies

It should be noted that the circulation of money in the world would be much better if cash flows were distributed more widely, smoothly, and evenly among all market participants. Now the picture is developing in a different way, corporations accumulate money supply, which mostly works only for them. Apple is one of the leaders in this regard, with billions and billions of dollars of free money in its accounts.

In the course of their exponential growth, the largest companies not only become richer and larger in size themselves but also enrich their founders. Billionaires do not just go to work, they are people who have created their own business.

In recent years, the issue of inequality has been increasingly discussed, especially in the United States. 61% of Americans say there is too much economic inequality in the United States and it has been growing exponentially over the past 30-plus years. And according to the latest figures, which were announced at the economic forum in Davos, the world's billionaires have more wealth than 4.6 billion people combined.

The situation with the fortunes of billionaires is the same as with large companies. Their funds pledged in securities or held in bank accounts, work and services exclusively for them and their immediate circle. Over time, rich people only get richer and poor people to get poorer.

And so far it is not known what will happen before the regulation of the distribution of capital in the world or the first-ever trillionaire on Earth. Just to remind, Jeff Bezos's fortune, at the moment, is already about $ 150 billion.

Small and medium businesses

Every business starts with something small and subsequently grows into something significant, provided it is managed correctly. Small and medium business is the foundation for the economy of any state.

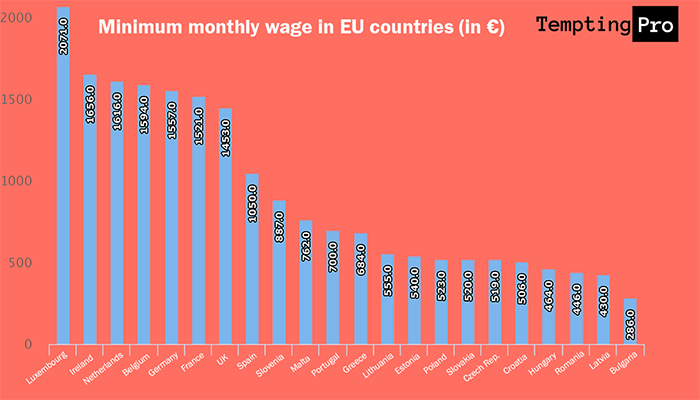

There is a ranking of the easiest countries to do business, which is annually compiled by the World Bank. Countries are ranked by how easy it is to open a legal entity there, how quickly you can find employees, how easy it is to get any kind of permission or credit, and even the availability of electricity.

And there is a certain correlation between the development and the economic situation of a country and the ease with which one can do business there. For example, if you live in New Zealand, you can start a new business in just half a day.

As you might guess, in the first 20 you will not find a single country from the former post-Soviet space (with the exception of Lithuania, Latvia, and Estonia, which have long gone their own way).

The high level of corruption, bureaucracy, and various other complexities instills uncertainty and fear in the heads of future entrepreneurs about the difficulties they may face. For many people, the initial stage of the emergence of an idea remains the first and last obstacle at the entire stage of starting a business, not even reaching the stage of trying to take any first actions, and not to mention the implementation and achievement of the stage of a ready-made business.

It cannot be said for sure that monopoly is good or bad. Each monopoly is a separate story. But we can definitely say that without the proper support of young companies and medium-sized businesses, which have just got on their feet, the overall progress and economic growth in the country will be greatly slowed down.

Prepared by: Alexander Boltrukevich alexbolt@tempting.pro

Latest articles

Why is camel milk so expensive?

How much does it cost to buy a private jet ticket?

Rating: the most popular world mass media (by attendance)

Study in one of the best language schools in London Oxford International (UIC) Greenwich, personal experience

How to rent an apartment in New York City